American Airlines and US Airways will merge and give birth to the largest airline

Here, after many months of negotiations and rumors, AMR Corporation (OTCQB: AAMRQ), the parent company of American Airlines, and US Airways Group (NYSE: LCC) announced the merger on a day full of love - February 14. The capitalization will be about $ 11 billion and will give rise to the largest airline in the world - the new American Airlines. The announcement of the merger came shortly after American Airlines has announced its rebranding, which foreshadowed the union of the two major US airlines.

The new airline will be led by Doug Parker, the current CEO of US Airways, and Tom Horton, the current CEO of American Airlines, will retire in 2014 and receive $ 19,875,000. Half of the amount will be in cash, and the other in shares in the new American. The board will have 12 members (three American Airlines representatives, including Tom Horton, four US Airways representatives, including Doug Parker, and five AMR representatives). There will be 11 left after Horton's retirement. AMR's creditors will hold 72% of the new company's shares, and those of US Airways the remaining 28% of the shares. The merger will not take place overnight, and in the next period will be subject to analysis by the US Department of Justice. The new carrier will be based in Dallas-Fort Worth.

American Airlines fleet - over 950 aircraft

If all goes according to plan, which I think will happen, the new American Airlines will have a fleet of over 950 operational aircraft. But the new American will also focus on expanding and modernizing the fleet. Both airlines have orders placed for approximately 600 of new and modern aircraft, which will be in service beginning in the summer of 2013.

In the coming 5 years, the American fleet will be one of the most modern and youngest. This merger will create a solid financial base and allow the air carrier to continue investments in technology, services and products. Regional airlines American Eagle, Piedmont Airlines and PSA Airlines will continue to operate as separate entities without being affected by the merger.

Destinations - over 330 destinations in 56 countries

Following the merger, the new American Airlines will operate more than 6700 daily flights to 336 destinations in 56 countries. The market in the United States will be slightly balanced. The new American will have the power and infrastructure to fight Delta Air Lines and United for premium customers and even regain those lost in recent years. Over the years, even US Airways has sold several slots to Delta at New York's LaGuardia Airport. An Innovata study shows that American Airlines - US Airways have 31% of departures from LaGuardia, and Delta Air Lines 40%. United enjoys 69% on Newark, but LaGuardia is the favorite of premium passengers. On JFK, American Airlines - US Airways have 19%, Delta 21%, quite balanced.

The new American Airlines will be able to take over the east coast of the United States, and this can be seen from the figures that show the activity of American operators at large airports. This offers the opportunity to operate much more long-haul flights in partnership with British Airways. At the same time, Delta is building a joint venture with Virgin Atlantic. It will be interesting to see how things will evolve on the New York - London route.

In the United States, large full-service airlines rely primarily on corporate customers, and most are in the eastern part of the North American continent. Following the merger, the new American will have a significant share of the eastern market and has a high chance of attracting a significant number of business people. From 2009 to mid-2012, American Airlines lost quite a bit of this market, while Delta managed to position itself at the forefront.

In the US market, New American Airlines (American Airlines + US Airways) will have a significant market share in the eastern and central United States and a leading position in the west. It remains to be seen whether everything will go according to plan, and the organizations empowered to analyze the merger will not get bogged down.

At 25 January 2013, an analysis of the networks of large 2 carriers shows that American Airlines operates 130 from destinations where US Airways is not present, and US flies to 62 from destinations where American is not present.

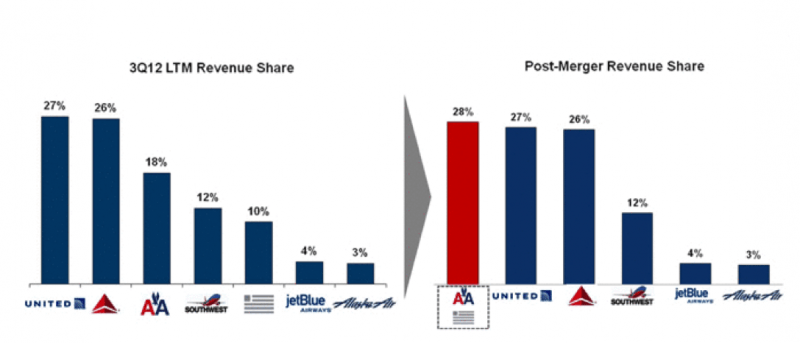

The merger between American Airlines and US Airways will reduce the number of major US airlines to four: the new American Airlines, United Airlines, Delta Airlines and Southwest. The rest have below 5% of the market, so they are not taken into account.

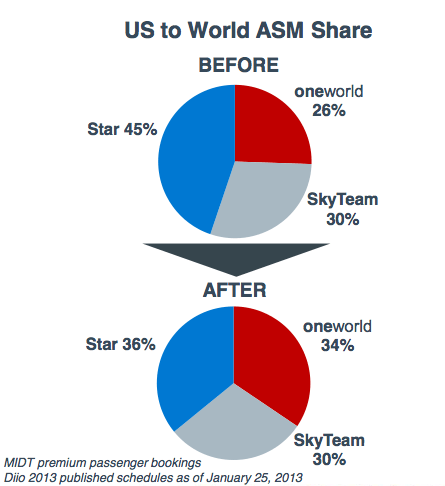

Air Alliances - US Airways will exit Star Alliance

Following the merger, the new American Airlines will remain in the Oneworld alliance, being a founding member. Under these circumstances, the US Airways operator will exit Star Alliance, where it has not been taken into account anyway. This would bring an important balance among alliances across the United States. SkyTeam with Delta Airlines will have 30% of the market, Star Alliance with United will have 36%, and Oneworld with American Airlines will reach 34% of the market. Before the merger of the two operators, Star has a share of 44% and not 45 as in the chart.

Thus, there are great chances to be able to fly to the United States at decent prices and we will have the opportunity to choose our alliance right from Bucharest. Czech Airlines, Aeroflot, Alitalia, Air France-KLM and TAROM are in SkyTeam, British Airways and Air Berlin are in Oneworld, and TAP Potugal, Turkish Airlines, Lufthansa and its subsidiaries SWISS and Austrian Airlines are in Star Alliance. High competition means more advantages for passengers.

So much for the moment, what the merger between American Airlines and US Airways could mean. It is expected that the merger could take place with full rights only in the 3 quarter of this year. But let's not forget that American Airlines is under bankruptcy law and there are many more analyzes and verifications to be done by the US state until it goes green. The point is that almost everyone involved in this process wants the merger, starting from employees to partner carriers. It would be up to the US authorities to reject this request.

I also tell you that, starting with 2008, the US airline market has been marked by a consolidation phenomenon through mergers between Delta Airlines and Northwest Airlines (2008), United Airlines and Continental Airlines (2010), as well as between Southwest and Airtran ( 2011). A similar phenomenon occurred in Europe, where British Airways joined with the Spanish operator Iberia, Air France joined forces with the Dutch company KLM, and the German group Lufthansa took over the companies SWISS, Austrian Airlines and Brussels Airlines. What will be the next mergers?

As far as I suspect, SAS will soon disappear from the map, or at least it will be bought, because it is in serious bankruptcy. And I don't know why I foresee either Lufthansa or AirFrance-KLM buying the Scandinavian company - rather the Germans, and they already have codeshares with SAS and all kinds of partnerships.

Yes, I was thinking about SAS. I'm also thinking about Czech airlines, Alitalia… The problem is that there are state-owned companies with large debts and there aren't many attractive offers